Fascination About Kam Financial & Realty, Inc.

Fascination About Kam Financial & Realty, Inc.

Blog Article

What Does Kam Financial & Realty, Inc. Mean?

Table of ContentsThe Greatest Guide To Kam Financial & Realty, Inc.The Greatest Guide To Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Can Be Fun For EveryoneOur Kam Financial & Realty, Inc. IdeasTop Guidelines Of Kam Financial & Realty, Inc.How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

When one thinks about that home loan brokers are not called for to submit SARs, the actual quantity of mortgage fraudulence activity can be much greater. https://www.domestika.org/en/luperector. Since very early March 2007, the Federal Bureau of Examination (FBI) had 1,036 pending home loan fraud investigations,4 compared to 818 and 721, respectively, in both previous yearsThe mass of mortgage fraud falls into two wide groups based upon the inspiration behind the fraudulence. usually entails a consumer who will certainly overemphasize earnings or possession values on his/her financial declaration to get a funding to acquire a home (mortgage broker california). In a number of these instances, expectations are that if the income does not rise to meet the repayment, the home will certainly be sold at an earnings from appreciation

The Ultimate Guide To Kam Financial & Realty, Inc.

The huge bulk of scams instances are discovered and reported by the institutions themselves. According to a research study by BasePoint Analytics LLC, broker-facilitated fraudulence has actually emerged as one of the most widespread segment of home mortgage fraud nationwide.7 Broker-facilitated home loan scams takes place when a broker materially misstates, misstates, or leaves out info that a car loan policeman counts on to decide to prolong credit history.8 Broker-facilitated fraud can be fraudulence for residential or commercial property, fraud commercial, or a mix of both.

The adhering to stands for an instance of scams for earnings. A $165 million community financial institution made a decision to go into the mortgage banking company. The financial institution bought a tiny home mortgage company and employed a seasoned home loan banker to run the procedure. Nearly five years right into the connection, an investor informed the bank that a number of loansall came from through the same third-party brokerwere being returned for repurchase.

Excitement About Kam Financial & Realty, Inc.

The bank alerted its main federal regulator, which after that contacted the FDIC since of the possible impact on the bank's economic problem (https://telegra.ph/Your-Trusted-Mortgage-Loan-Officer-California---KAM-Financial--Realty-Inc-08-28). Further investigation revealed that the broker was operating in collusion with a building contractor and an evaluator to flip residential or commercial properties over and over once again for greater, bogus earnings. In total amount, even more than 100 car loans were originated to one contractor in the same community

The broker refused to make the settlements, and the situation went into litigation. The bank was eventually awarded $3.5 million. In a subsequent conversation with FDIC inspectors, the financial institution's president suggested that he had always heard that one of the most difficult part of home mortgage financial was making certain you executed the best hedge to offset any kind of rates of interest take the chance of the financial institution may sustain while warehousing a considerable volume of mortgage finances.

All About Kam Financial & Realty, Inc.

The bank had depiction and warranty clauses in contracts with its brokers and assumed it had recourse relative to the car loans being come from and sold through the pipe. Throughout the litigation, the third-party broker argued that the financial institution should share some obligation for this direct exposure due to the fact that its inner control systems need to have identified a finance concentration to this community and set up actions to prevent this risk.

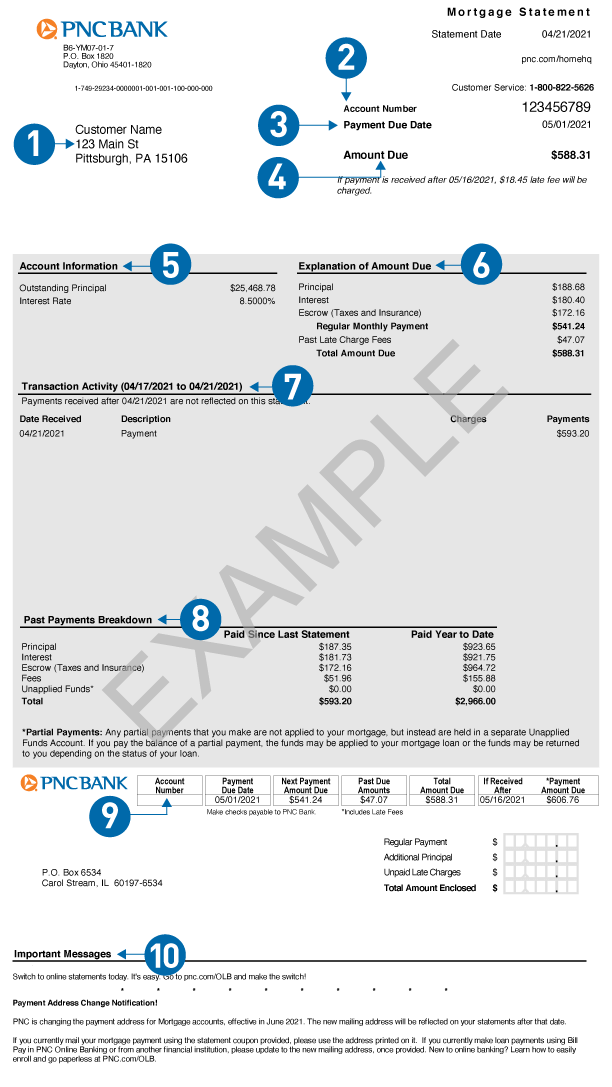

What we call a regular monthly home mortgage repayment isn't just paying off your mortgage. Instead, believe of a month-to-month home loan settlement as the 4 horsemen: Principal, Rate Of Interest, Residential Or Commercial Property Tax, and Property owner's Insurance coverage (called PITIlike pity, because, you understand, it raises your settlement).

Hang onif you assume principal is the only quantity to take into consideration, you 'd be neglecting concerning principal's ideal good friend: rate of interest. It would certainly be good to think lenders allow you obtain their cash simply because they like you. While that may be true, they're still running an organization and intend to place food on the table as well.

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

Rate of interest is a percentage of the principalthe quantity of the finance you have entrusted to repay. Rate of interest is a percent of the principalthe amount of the lending you have entrusted to pay off. Mortgage rates of interest are continuously changing, which is why it's wise to select a home loan with a set passion rate so you know useful content just how much you'll pay every month.

That would certainly suggest you would certainly pay a monstrous $533 on your very first month's home loan settlement. Obtain all set for a little of mathematics right here. However don't worryit's not complex! Utilizing our home mortgage calculator with the instance of a 15-year fixed-rate home loan of $160,000 again, the total passion price mores than $53,000.

Kam Financial & Realty, Inc. Things To Know Before You Buy

That would certainly make your month-to-month mortgage repayment $1,184 every month. Month-to-month Principal $1,184 $533 $651 The next month, you'll pay the very same $1,184, yet less will certainly most likely to rate of interest ($531) and more will certainly most likely to your principal ($653). That fad proceeds over the life of your mortgage up until, by the end of your home mortgage, almost all of your settlement approaches principal.

Report this page